Request to Pay

Benefits &

Features

Use "Real-Time Request to Pay" to Send & Receive Certified Good Funds in "Seconds"

Instant Real-time Deposits into your Existing Bank Account!

- All RtP Real-Time payments are "Credit Push" instead of "Debit Pull."

-

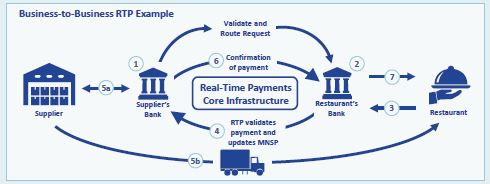

RtP's systems use for both Federal Reserve's FedNow™ and The Clearing House RTP® owned Real-Time Payment "Rails" that can reach all U.S. bank and credit union accounts and enable funds to be sent and received within seconds.

- Now Available to you:

- Fastest Payments

- Instant E-Invoicing

- Final Payments

- Good Funds Payments

- Immediate Payments

- Instant Payments

- Just-in-Time Payments

- Last-Minute Payments

- Last-Second Payments

- On-Demand Payments

- Request for Pay

- Request to Pay

Features & Benefits

RtP

Real-Time payments has benefits for all parties involved in Financial Transactions.

Consumers who use the RTP system will be protected under existing federal consumer

protection requirements, including as provided by the Electronic Funds Transfer Act and its

Regulation E, applicable Unfair, and Deceptive and Abusive Acts and Practices statutes and

regulations. In addition, Article 4A of the New York Uniform Commercial Code establishes a default, end-to-end framework of

rights and responsibilities for banks and their commercial customers engaged in "fund transfers" (e.g., with respect

to security procedures and liability for unauthorized transactions). This framework will apply to business-to-business

payments conducted through the RTP system.

What is Request to Pay

Request for Pay, a new standard for requesting a payment, is an exciting new "digital overlay service" facilitating real-time payments through instant invoicing using RTP® payments that are instant, final (irrevocable - "good funds") and secure. A

Request to Pay

, RtP

™, is also referred to as a RtP

Invoicing.

RtP

™ is fast, secure and convenient a way for a person or business (the requestor) to request an instant payment from another person or business (the recipient). Both terms, Request to Pay and Request to Pay are generic umbrella terms for a number of scenarios in which a payee ( Biller ) sends the

initiative to request a specific payment from the payer ( Customer ). Soon invoices become real-time, even Point-of-Sale, and instant will beyond traditional invoicing. Request to Pay communication via Digital Mobile / Text / Email message. Working with

BillPayExchange - "Request for Pay".

Request for Pay, a new standard for requesting a payment, is an exciting new "digital overlay service" facilitating real-time payments through instant invoicing using RTP® payments that are instant, final (irrevocable - "good funds") and secure. A

Request to Pay

, RtP

™, is also referred to as a RtP

Invoicing.

RtP

™ is fast, secure and convenient a way for a person or business (the requestor) to request an instant payment from another person or business (the recipient). Both terms, Request to Pay and Request to Pay are generic umbrella terms for a number of scenarios in which a payee ( Biller ) sends the

initiative to request a specific payment from the payer ( Customer ). Soon invoices become real-time, even Point-of-Sale, and instant will beyond traditional invoicing. Request to Pay communication via Digital Mobile / Text / Email message. Working with

BillPayExchange - "Request for Pay".

Request to Pay RtP ™ and Request to Pay RtP

Request to Pay RtP ™ is the term in the United States with European countries term as

Request to Pay RtP.

The basic idea behind Request to Pay, or R2P, is to simplify payments through digital invoices. With R2P, no printed invoices are sent to the customer; rather they are sent electronically via a platform directly into the customer's online banking system, where the customer can manage his invoices. In addition to the environmental advantage, the risk of errors being inadvertently introduced by the customer when making the payment is eliminated, the distribution of the payment initiation details being done electronically and instantly. The combination of Request to Pay technology and real time payments, will enable an alternative to direct debit and biller-direct models, providing more optionality for different customer segments, reducing time, inconvenience and risk of inaccuracy for payers and billers alike.

Basically, RtP is a digital invoice. The Billers and their Customers desire the most various payment methods. Customers want to use Credit & Debit Cards, ACH, Real-Time Payments (through either The Clearing House or the FedNow), ZELLE, VENMO, PayPal, etc.

Benefits to your company include:

- Money Transfer: Current limit of $1,000,000 per transaction.

- It's Fast: 24/7/365 access to funds anytime vs. several days for paper checks or ACH transfers to process.

- It's Final: Real Estate companies can disburse funds to their Vendors, Agents or Rebate discounts to their customers' bank accounts or mobile wallets.

- Software Integration: Integrate your Management or Enterprise software with us.

- Message Detail: Full 145 characters available using ISO 20022 XML format.

- Online Down Payments: Don't use inconvenient and expensive Wires & Cashier's Checks.

- Online Real-Time Reporting: Configured Dashboard with Virtual Terminal login.

- Request to Pay: Replace paper invoicing with Mobile / Text / Email message request to pay

- Reduced calls / emails in the "Purchasing Chain": All parties to a "RtP Real-Time payments" transaction receive text & email messaging.

Your Choice ~ Integrate your software system with us or, send us your API and we'll integrate Real-Time Payments with YOU!

Why use RtP Real-Time payments?

When "Next-Day" or "Same-Day" payments are too slow or using Wires costing $25 are too expensive - think RtP RTP:

-

RtP Real-Time payments are SAFE:

It is safer than cash or checks in protecting users against fraud. The platform uses transaction limits and cross-border blocks to avert money laundering. eCheck transactions, using bank login authorization, are the most secure method of funds transfer available. Fraud Protection: Identify, manage and prevent suspicious or potentially costly fraudulent transactions with our customizable, rules-based solutions.

- Instant - funds will be received in seconds.

- Flexible - send or receive one-time and recurring payments.

- Easy - it's all done online or via your mobile device, no need to visit the bank.

- Quick - takes seconds to set use once your company is approved.

- Secure - money goes directly into the recipient's account of choice.

- Convenient - funds can be instantly accessed and spent.

- Inexpensive - one of the cheapest on the market as there are no costs for the receiver.

- Automate Agent Commission Payments (and other Account Payables)

- Automate Account Receivable Collection

- One-time and Recurring Debits / Credits

RtP Real-Time payments are FREE to Receiving Party:

Your Recipients will never be charged enrollment or transaction fees.RtP Real-Time payments are FAST:

24/7/365 access to funds anytime.RtP Real-Time payments are EFFICIENT:

The platform makes digital payments effortless and more efficient. We drive efficiencies and cost savings RTP messaging service has created a complement existing payments infrastructure and gives billers the ability to request payment for a bill rather than simply sending an invoice or a bill.RtP Real-Time payments are EASY TO USE:

It connects users across the globe all through one digital hub. Worried about Internet security? DON'T BE:After a transaction is processed, you'll even receive an e-mail with amount confirmation and receiver information. Plus, our payment platform gives you the ability to manually key-in transactions anywhere there's an Internet connection.

More than Same-Day ACH:

RtP Real-Time payments doesn't share banking information between parties:

"...consumers and businesses indicated that they would rather share an e-mail address or a phone number to make/receive payments instead of sharing their bank account numbers." Page 29, Strategies Improving US Payment SystemCredit Transfer:

Basic multi-purpose payment message, including remittance information.Request to Pay :

RtP � to support P2P funds request and EBPP - Electronic Bill Presentment & Payment.Payment Acknowledgement by Receiver:

Message from the receiver to the sender regarding payment dispositions (e.g. invoice paid, good shipped, etc.).Request for Information & Response:

Receiver request for additional information about a payment (e.g. requesting customer account number, invoice number, or purpose of payment).Remittance Advice:

Extensive remittance detail not included in the Credit Transfer message.Sending money with RtP Real-Time payments is:

QuickBooks Integration INCLUDED!

QuickBooks® Integration: RtP Real-Time payments specializes in the origination of moving money electronically. Use QuickBooks accounting software and our online virtual terminal gateway software to send and receive Good Funds transactions over the internet.

Have Questions?

We have fast, friendly support!.

Our in-house experts are standing ready to help you make an informed decision to move your company's payment processing forward. Allow us to offer and create an electronic payment processing program to provide you access to your funds in an expeditious manner.

Compare our service and prices to our competitors and

Give Us A Call

(866) 927-7180