| Author: Leigh Cook, CEO

Complete Guide to Real-Time Payments

Wow, these are exciting times in the payments' industry. It's time to enroll with the new Real-Time Payment (RTP) rails offered by The Clearing House and the impending introduction of The FedNow

instant payment Service, by the U.S. Federal Reserve, offer all Americans, both individual consumers and businesses, services and developing payment solutions that will change their lives forever.

Although other developed countries offer Instant Payments or Immediate Payments, this guide will be substantially limited to Real-Time services and solutions offered in the United States.

We believe the course for the Real-Time Payments is broadening to ever growing - so much, that we owe Real-TimePayments.com.

Apply the following information to your business. The new 24/7/365 payments environment means you can send and receive payments any time of day and any day of the week. Instantaneous Real-time Payments are transforming the payment landscape for use cases served inefficiently with existing domestic payment infrastructures. The solutions and services are evolving in the real-time payment niche. This document is a good "first-start" in compiling data for your use. Check back from time-to-time for updates. Or, simply provide us your contact information and we'll update you as significant changes are made.

For the last several years I have watched at least two webinars weekly, attend banking conventions and participated in national programming development groups, sponsored by private industry and the U.S. Federal Reserve. Faster payment settlements are great but, Real-Time Payments will have the greatest impact on our lives and economy via technology used. Technology companies, outside the current players of MasterCard, The Clearing House and the Federal Reserve will serve-up apps and APIs enabling all types of new products and services. Imagine not ever "over drafting" your checking account again. How about aggregating all your bank accounts, with no limit on the number of banks you have deposits with and transferring money between accounts intra-bank and interbank instantly with no fees. Oh sure,

you can use that same aggregated platform to pay all your bills and choose which account to pay your bills with and what type of payment to use. These types of platforms will work for both Individuals and Businesses. The GUI, Graphical User Interface and UX, User Experiences will be fundamental for the success or failure of this "new tech." Keep your eyes on Open Banking APIs, Application Programming Interfaces, through Open Bank Project, Afinis and the Financial Data Exchange FDX APIs.

The FDX has the potential to be used by more FinTechs in the U.S. since the organization already has end-point connections with over 12,000 banks and credit unions.

Banks typical make money in three ways: deposits, loans and payments. Digital bill payments can be broadly divided into five phases: pre-transaction (purchase order A/P), authentication/authorization, clearing, settlement and post-transaction (ERP and accounting integration). Non-banks have increased their presence in all phases, except the settlement phase, which is still core to banks’ activity.

Banks’ role may now be reduced to Depository Only. With interest rates at historical lows, banks need to find new ways of making money from payments and they are doing that by looking at value-added services to overlay on real-time payment transaction. These value-added services are known as: Digital Overlay Services. I believe Request to Pay is most exciting of the new Overlay Services, because it has the potential to eliminate invoice fraud and is a flexible instrument which makes it easier to get paid. Currently, financial institutions control who can send money, who can receive money and what the associated fees are and who pays what share. A prediction for the future: Businesses will not have to be underwritten by a merchant acquiring bank to accept payments. The Payer and Biller will interact directly through financial technology provided through Open Banking using authorized Third Party Providers. Business billers will save billions of dollars in interchange, association and other transaction fees.

Why use Real-Time payments?

When "Next-Day" or "Same-Day" payments are too slow or using Wires costing $25 are too expensive - think Instant Real-Time Payments:

-

Real-Time payments are SAFE:

- It is safer than cash or checks in protecting users against fraud. Today Payments' platform uses transaction limits and cross-border blocks to avert money laundering. Instant RTP transactions, using bank login authorization, are the most secure method of funds transfer available.

Real-Time payments are FREE to Receiving Party:

- We will not charge your Recipients who accept the RTP transaction enrollment or transaction fees. Of course, you may charge your Payees a Service Fee or Customer Service Fee.

Real-Time payments are FAST:

- 24/7/365 access to funds anytime.

Real-Time payments are EFFICIENT:

- Our platform makes digital payments effortless and more efficient. We drive efficiencies and cost savings.

Real-Time payments are EASY TO USE:

It connects users across the globe all through one digital hub. Worried about Internet security? DON'T BE:Fraud Protection: Identify, manage and prevent suspicious or potentially costly fraudulent transactions with our customizable, rules-based solutions.

After a transaction is processed, you'll even receive an e-mail with amount confirmation and receiver information. Plus, our payment platform gives you the ability to manually key-in transactions anywhere there's an Internet connection.

More than Same-Day ACH:

Our solutions for Real-Time payments don't share banking information between parties:

- "...consumers and businesses indicated that they would rather share an e-mail address or a phone number to make/receive payments instead of sharing their bank account numbers." Page 29, Strategies Improving US Payment System

Credit Transfer:

- Basic multi-purpose payment message, including remittance information.

Request for Payment:

- Support Account-to-Account funds request and EBPP - Electronic Bill Presentment & Payment.

Payment Acknowledgement by Receiver:

- Message from the receiver to the sender regarding payment dispositions (e.g. invoice paid, good shipped, etc.).

Request for Information & Response:

- Receiver request for additional information about a payment (e.g. requesting customer account number, invoice number, or purpose of payment).

Remittance Advice:

- Extensive remittance detail included in the Credit Transfer message.

Sending money with Real-Time payments is:

- Instant - funds will be received in seconds.

- Flexible - send or receive one-time and recurring payments.

- Easy - it's all done online or via your mobile device, no need to visit the bank.

- Quick - takes seconds to set use once your company is approved.

- Secure - money goes directly into the recipient's account of choice.

- Convenient - funds can be instantly accessed and spent.

- Inexpensive - one of the cheapest on the market as there are no costs for the receiver.

QuickBooks Integration INCLUDED!

- Automate Account Receivable Collection

- One-time and Recurring Debits / Credits

QuickBooks® Integration: We specialize in Real-Time payments in the origination of moving money electronically. Use QuickBooks accounting software and our online virtual terminal gateway software to send and receive Good Funds transactions over the internet.

Our integrated QuickBooks payments for Credit Cards, ACH & Real-Time Payments is not a "Sync". Process payments directly through your QuickBooks Desktop Enterprise, Premier and Pro software. We own the QuickBooks Plug-in!

Check it out.

Real-Time Payments News

- A2A Business Payment Service

January 2020

- Real-Time Payments Whitepaper

January 2019

- Federal Reserve Real Time Payments

April 2019

- MasterCard Real Time Payments

May 2019

- Avidia Bank offers Real Time Payments

August 2019

- FedNow® Service - U.S. Federal Reserve's Real-Time Payments coming 2023

November 2019

- Are all Real-Time Payments "Good Funds"?

November 2018

- Visa's Business Payments Network

March 2017

- Business Real Time Payments

April 2017

- Businesses Will Switch Banks For Real-Time Payments

February 2016

- Real Time Payment System in United States

March 2016

- Secure Exchange Launches Real-Time P2P Payments with Bank of America, U.S. Bank

July 2016

- Visa Direct Real-time Network

November 2016

- Real-Time ACH Payments

March 2015

- The Road to Faster Payments: A Banker's Guide

- MasterCard launches "MasterCard Send"

- Real-time Good Funds Network

- Faster Payments Strategy Leader <

November 2015

- Real-Time Deposit of Business Payment Transactions

Whitepaper: Complete Guide to Real-Time Payments

Open Banking Real-Time Payments

Real-Time Payments Report - World

Instant Payments Guide

NACHA's approach to Real-Time Payments / ACH 2015

FedWire / FedNow Federal Reserve Supports Real-Time Payments

FedNow - Delivering Fast Payments for All

Federal Reserve - Supporting Fast Payments for All

Real-Time Payments discussing by Federal Reserve

Evaluation of Finality of Payment Rules

Federal Trade Commission - Telemarketing Sale Rule - Final Rule

International Wire Quick Reference

International Wire Via Fed Wire

Payment Finality And Discharge In Funds Transfers

Regulation CC

Regulation E - Electronic Funds Transfer Act

Regulation J - FedNow Service by establishing a new subpart C

Regulation X - Real Estate Settlement Procedures Act

ACH Standard Entry Class Codes

Real-Time ACH Payments

Faster Payments Task Force Final Report (part 2)

Federal Reserve - Faster Payments Initiative

Federal Reserve Banks

NACHA - National Automated Clearing House Association

Secure Exchange - Good Funds Network

Real Time Payments - The Clearing House

Real Time Payments using Block Chain and Distributed Database

| Real-time Payments expand the satisfaction of immediacy with instantaneous results. Workers delivering services on demand get payment on demand. Merchants get paid within seconds for instantly fulfilling customer needs. We all know that instant insurance payouts, daily payroll and real-time loan proceeds, etc. are very important to the receiver. The following sections will describe the various payment types but not the individual use cases. We will not list the 101 uses for real-time instant payments in this guide. | |||||||||||

Review the numerous sections and payment types below to determine which one(s) are correct for your company |

|

Real-Time Payment Types

- Bill Pay - Ecommerce Payments - Fastest Payments - Final Payments - Just-In-Time Payments - Last Day Payments - Last Minute Payments - MasterCard Send - On-Delivery Payments - On-Demand Payments - On-Time Payments - Point of Sale / Retail Payments - Real-Time ACH - Real-Time Credit Card Processing - Real-Time Invoicing - Request For Pay - Request To Pay - Telemarketing: Inbound and Outbound - Venmo - Visa Direct - Zelle

Real-Time Payments that are "Good Funds"

- Good Funds Definition - Real-Time vs. Instant vs. Immediate Payments - The Clearing House Real-Time Payments - FedNow Services Real-Time Payments

Banks offering Real-Time Payments

- The Clearing House Real-Time Banks - The FedNow Service Real-Time |

Accept and Send Real-Time payments. Keep your existing bank account at your current bank. Have Questions? |

Real-Time Payments (RTP) that are "Good Funds"- Good Funds DefinitionOur definition of Good Funds: Settled funds in a bank account, that are final and irrevocable, and usable instantly by the owner of the account.

Good Funds for Real Estate

- Real-Time vs. Instant vs. Immediate Payments A lot of confusion exists in whether a real-time instant payment, which I discuss below with Real-Time Credit Card and Real-Time ACH processing, method is final and irrevocable, aka:

Good Funds. Good Funds are immediately settled funds in a bank account that are irrevocable, intra-bank and/or interbank

account-to-account (A2A) transfers and instantly usable by the owner of the account. Most Good Funds transactions are "Credit Push" versus "Debit Pull."

Businesses and Consumers, because of convenience, immediacy of payment, lower costs and the informational data that accompanies the money will both turn to RTP instead of using Wires to send money.

- The Clearing House Real-Time Payments

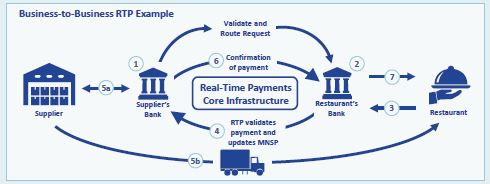

Real-Time Payments via The Clearing House are GOOD FUNDS! The RTP® (Real-Time Payment) network, the real-time payments system from The Clearing House, is the first new core payments infrastructure in the U.S. in more than 40 years. RTP® is not Real-Time ACH. The RTP System enables Participants to initiate credit transfers, receive final and irrevocable settlement for credit transfers, and make available to Receivers funds associated with such credit transfers in real-time, 24/7/52 a year. The Clearing House is a private corporation owned by the nation's largest banks. Combined, these banks control in excess of over 60% of all bank accounts! See Banks processing RTP through TCH - FedNow Services Instant Payments Real-Time Payments via The FedNow Service by the United State Federal Reserve are GOOD FUNDS!

Federal Reserve Banks will develop a new round-the-clock real-time payment and settlement service, called the

FedNow ® Service, to support faster payments in the United States.

The figure below illustrates a completed payment over the FedNow Service in its simplest form. This process is designed to take place within seconds.

Features & Benefits of Good Funds RTPFedNow & TCH Real-Time instant payments have benefits for all parties involved in financial transactions.

Your Choice ~ Integrate your software system with us or, send us your API and we'll integrate Real-Time Payments with YOU! |

Enroll for Real-Time Payments and keep your current bank account:

~ AmEx Bank ~ Avidia Bank ~ Bank of America Real-Time Payments ~ Mellon Bank ~ BB&T Bank ~ Capital One Bank ~ Charles Schwab Bank ~ Chase Bank ~ Citi Bank ~ Citizens Bank ~ Comerica Real-Time Payments ~ Discover Bank ~ E-Trade Bank ~ Fifth Third Bank ~ Goldman Sachs Bank ~ Huntington Bank ~ Key Bank Real-Time Payments ~ Morgan Stanley Bank ~ MT Bank ~ Northern Bank ~ Regions Bank ~ State Street Bank ~ SunTrust Bank ~ US Bank Real-Time Payments ~ Wells Fargo Real-Time Payments |

Real-Time Payment Service & Solution Types- Bill PayOh my, where should we start? Out of all the services and solutions slated for RTP, Bill Payments will be the category which sees the greatest benefits, both in speed of payment and real-time expansive messaging that will accompany the transaction.

- Ecommerce PaymentsReal-Time payments will have a great impact on web-based Ecommerce transactions. Merchants can now ship the ordered goods with confidence of getting paid. The immediacy of deposit will now allow the merchant to ship immediately, even on weekends. A lot of work, by all involved in the payment and distribution chain is still to be done.

Currently, when paying for the products in our shopping carts we are provided two options to pay: Credit Cards or Echeck (bank A2A) transfer. All shopping cart developers will have to add a new button to allow for instant payment. What this instant payment graphic will look like or the common term used to associate this payment has yet to come to market.

We are all familiar with this graphic - Fastest PaymentsAlthough, the terms "Instant" and "Real-Time" are used, reality is, that it's acceptable for the payment transaction to settle in less than 5 seconds. NACHA introduced Same-Day ACH with several daily settlements Monday - Friday. For a lot of transaction types and relationship of the parties involved "Same-Day" is fast enough. In the near future, payment transactions titles will "FADE" with the parties using the "Speed" of the funds as the description. I can see it now: "Do you want your money by tomorrow, today or immediately". It will be up to the payments platform to offer the choices in a frictionless, ubiquitous manner. - Final PaymentsWe all know that Credit Card transactions come with a 6-month time period for the card holder to notify their issuing bank that a particular charge was either a mistake, incorrect, fraud or non-delivered goods or services. The title is "Chargeback". Well, the same is possible (although most persons don't know it is) with ACH debits, whether one-time or recurring. All ACH transactions must be Authorized in advance. A person may "Revoke" the debit transaction due to mistake, incorrect, fraud or non-delivered goods or services. This revocation

document must be signed, under penalties of perjury by the bank account holder. Depending upon the Standard Entry Class SEC code used in the transaction, the account holder may have only 3 - 60 days to revoke the transaction.

- Just In Time PaymentsHave you ever heard of Just-in-time (JIT) inventory system? It is a management strategy that minimizes inventory and increases efficiency. Well, because of the advantages of speed and transactional data attached to a real-time payment, retailers and manufacturers don't have to "over order" goods and suppliers don't have to wait on payments. Just-in-Time-Payments can be established on a recurring basis with integration into Enterprise Management Systems, Accounting Systems, etc. See On-Delivery Payments below. - Last Day PaymentsLast-Day Payments have the biggest advantages to Payers. Imagine now how easy it will be for businesses to take advantage of trade discounts in when in the time period established by their Suppliers. No more mailing a check 3-5 days before the payment is due hoping that the payment is received and processed timely.

- Last Minute PaymentsI hate to admit it but most of us have experienced situations where the cable company, utility provider

or other service provider has threatened late fees, termination or worse, legal action if payment is not timely. Persons will now be able to conveniently make these last-minute payments.

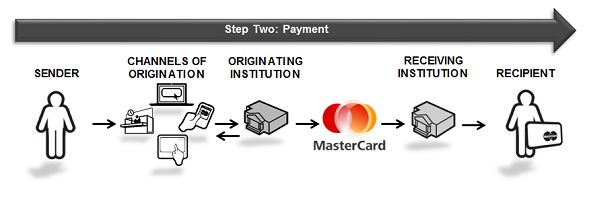

- MasterCard SendMasterCard Send™, a real-time solution, appeared in the marketplace in 2018, allowing credit-push transactions to be sent world-wide in seconds using bank accounts attached to debit cards.

"Card-based push payments enable participants to

send funds directly to consumers and small

businesses via their payment card accounts. Receipt

of funds via a payment card – typically a debit card

linked to a deposit account..." see A new push for push payments, MasterCard. In my owns words: MasterCard Send is a real-time payments product

that allows for cash disbursements between consumers or businesses,

or from businesses to individuals. MasterCard Send is the only

personal payments service that can reach virtually all U.S. debit

card accounts and enable funds to be sent and received typically

within seconds, both debit cards and prepaid cards are available for the transactions.

See our page Frequently Asked Questions for MasterCard Send.

Here are FAQs directly from MasterCard.

You get the flexibility to process transactions directly from your integrated software solution or manually keying them into our Virtual Terminal: Financial institutions offering MoneySend money transfer services engage

in two transactions to accommodate the money transfer between the Sender and

the Recipient: a funding transaction and a payment

transaction. MasterCard provides a Funding transaction to move money from the sender

(customer) to the Originating Institution (the financial institution

providing the money transfer service); that transaction can be initiated

through the MoneySend API. The MoneySend Payment Transaction transfers funds from the Originating

Institution, via the MasterCard Network, to the account identified by the

Recipient at the Receiving Institution. Funds can be transferred to a

consumer, credit, debit or prepaid MasterCard®, Cirrus®, or Maestro®

account. The Originating and Receiving Institution must both have the

ability to process MoneySend transactions. - Mobile Real-Time PaymentsMobile Bill PayMobile bill payments, using real-time technology, will see the largest transactional share compared to all other areas of payments. Consumers will have the option of paying their Billers direct via the Request to Pay or Request for Pay (both names will be used interchangeably for digital invoicing) or logging into their bank's Online Bill Pay section and selecting Real-time Payment RTP instead of Credit Card, ACH or account-to-account transfer: See Bill Pay Exchange above. - On-Delivery PaymentsFinally, On-Delivery Payments will eliminate delivery personnel from collecting checks or having office staff keying-in credit card data called-in from the recipient, having it downgrade and paying higher inter-change fees. Swiping Credit Cards, in-person, is not always possible when deliveries arrive. Now, the Vendor can send the Request to Pay notice to appropriate personnel either before or when delivery is made. - On-Demand PaymentsNo more "The check's in the mail" response from Payers. Payments made on-demand with immediate settlement bring surety to commerce. All parties benefit. Payees can mail or deliver their goods and services with confidence that the payment just received is final upon settlement in their bank account. The parties to a last-minute on-demand payment can transact business anytime now, even outside "banking hours". Keep in mind and get used to transacting business 24/7/365. - On-Time PaymentsOn-Time payments are a basic covenant to instant real-time payments. Of course, if the Payer doesn't send RTP, the payment will be late, no system can force a payment to be made. RTP systems are built for instant deposits and settlements through electronic digital means and not having to wait on mail delivery of checks and statements. The RTP system also eliminates "late postings" on the part of the biller's accounts receivable personnel. - Point of Sale / Retail PaymentsI can't remember the last time I saw a person write a check while checking out. Retailers and Consumers alike don't like long check-out lines. We all appreciate the speed, and "cash-back" opportunity, that cards provide in paying for goods. Once POS systems are installed for Real-Time send capabilities, we will see Consumers using the credit-push functionality of RTP. A form of Request for Payment will be sent by the retailer to the consumer instantly. The consumer in-turn will acknowledge receipt of the request and approve the funds to be immediately debited from her bank account and sent to the retailers bank account. This entire transaction will take less than 1 minute to complete which, I believe, is totally acceptable for both parties and especially those waiting for their turn to pay for their goods. Cash-back, and other discount opportunities will still be available using a Real-Time Payment at checkout. - Real-Time ACHNot all Real-Time Payments are Good

Funds. The discussion of Same-Day ACH having 2 (a third coming in 2021) settlement windows is a huge step-forward from the customary 3 business-day settlement provided by the banks for over 40 years. Although, The Clearing House, has primarily been a provider of ACH transactions, some industry people and most businesses will refer to RTP as Real-Time ACH. It makes sense, both RTP and ACH are intra-bank / interbank transfers from one depository

account to another. But, I want to clear up the technical confusion: TCH providing RTP is a different "rail" than the ACH networks. Vocalink, owned by MasterCard, is the system used by The Clearing House which is not an ACH network.

- Real-Time Credit Card ProcessingNot all Instant payments are Good

Funds. Although having the feature of real-time settlement, in part, because of Debit capabilities and the inclusion of Credit Card processing, are not Final and Irrevocable. Not all Real-Time Payments are Good

Funds. Real-Time Credit Card Payments and Real-Time ACH, although having the feature of instant settlement upon batching are not Final and Irrevocable. Instant Real-Time Merchant Settlement is now available from numerous processors. A "convenience" fee ranging up to 1.5% of the gross deposit is being charged to merchants.

This convenience fee is charged in addtion to inter-change, association and transaction fees. A requirement to receive faster funding is to "batch out." Unless the merchant closes-out, at anytime of the day or night, and possibly multiple times during the day, the payment processor doesn't know what amount to send the merchant. Credit Card payments, like ACH, are processed and settled in batches and not individually like TCH RTP. See Final Payments above for more information.

- Real-Time InvoicingIndustry experts are predicting Request to Pay & Request for Pay will supplement and eventually replace Invoices - at least for those Payees electing RTP versus ACH or Card payment. At the very least, Accounts Receivable Invoicing software companies need to add Real-Time Payments to their payment choices available to Payers. Billers will need to configure their billing and ERP systems to send out RfP's and RtP's as a new option to accept real-time instant payments. As payments move faster, ERP and Treasury Management Systems, TMS will need to move balance and transaction information faster, as well to manage business liquidity. - Request For PayPayment requests have been around since the first commercial transaction. But, Real-Time Payments lingo, through The Clearing House, has brought us Request for Pay, RfP®. Request for Pay is a digital overlay service. A Request for Payment is a payment-related message (ISO20022 pain.013)

that is sent electronically by a Biller to their Customers. The

response from a Payer / Customer is a RTP. Ease of mind: Since RfP messages contain all the relevant Biller information, they ensure the Customer-approved payment will be recorded correctly by the Biller.

- Request To PayMobile / Text / Email message request to pay. Works with BillPayExchange - "Request to Pay" started out as England's version of the US TCH "Request for Pay". Request to Pay and Request for Pay are now synonomous phrases. Request to Pay is a digital overlay service. It’s a messaging service that has been created to complement existing payments infrastructure and gives billers the ability to request payment for a bill rather than simply sending an invoice or a bill.

- Telemarketing: Inbound and OutboundOutbound Telemarketing has been out of favor with payment processors for years. Most processors place Telemarketers on High Risk or Prohibited status. This dis-favor is due to many reasons, confusing marketing scripts, non-authorized account debits, types of products and services being sold, undefined continuity payment plans and persons providing unscrupulous persons their banking information.

Great news: Payers don't ever have to provide their credit card numbers, banking account number or other payment credentials when a real-time payment is chosen. All Payer financial remains private and never devulged to these sales rooms.

- VenmoVenmo is a mobile real-time payment service now owned by PayPal. Since sender's can use numerous products to fund the instant transfers, the payments are not considered Good Funds. I used it for the first time this year in paying the "team mom" for my son's little league baseball uniform. It was an easy transaction for all involved. It's now become a noun: "Just Venmo me the money," now that's broad-base acceptance. Good for you PayPal. As with other payment types, the associated fees increase with the speed in delivery of the funds. MasterCard has issued a card for Venmo members wishing such. - Visa DirectInstant Real-Time deposits are available using Visa Direct™. Visa Direct is an innovative service that financial institutions, and now merchants, can offer to enable secure money transfers to millions of participating Visa cards globally, both debit cards and prepaid cards.

Visa Direct™ (formerly known as Visa Money Transfer) is a payment service that lets people

send money to millions of eligible Visa accounts around the world through the

Original Credit Transaction (OCT). Visa Direct consumer and business

Applications include: You get the flexibility to process transactions directly from your integrated software solution or manually keying them into our Virtual Terminal: - ZelleZelle is the banks' competitor to PayPal's Venmo. Early Warning, a company owned by major U.S. banks, developed, owns and controls the Zelle system. Consumers, and now small businesses, are using this bank enabled payment system to send and receive money "instantly". I placed "instantly" in quotation marks on purpose. Users of the system believe that the funds move instantly with real-time settlement. Such is not currently the case. Banks participating in the system communicate electronically creating debit and credit files for nightly reconciliation. The actual funds are sent via Same-Day ACH. Accordingly, even though participants receive real-time notice of the transfer, with the funds settling in batches the transferred funds are not "Good Funds". Zelle may be "later to the game" but it's processing volumes dwarf Venmo's. Like Venmo, Zelle is currently only available in the United States. |

Accept and Send Real-Time payments. Keep your existing bank account at your current bank. Quick Comment FormPricingWe provide integrated Real-Time Payments into your software! |

Banks offering Real-Time Payments - The Clearing House Real-Time Payment Banks List

Listing of Banks offering RTP by The Clearing HouseThe Clearing House allows all U.S. Financial Institutions (FI) to participate in offering Real-Time Payments. FI's can offer "send only" or "send and receive". Because of development and operational costs most banks and credit unions will offer "send only" capabilities. The larger banks and smaller FI's, working through Third Party Service Providers, such as FiServ, ACI Worldwide, FIS, Jack Henry, etc., will provide their commercial business deposit accounts the ability to send and receive payments in real-time. Accept and Send Real-Time payments. Keep your existing bank account at your current bank.Apply NOW Major banks offering Real-Time Payments through The Clearing House:JP Morgan Chase Bank ~ Chase Bank Real-Time Payments Bank of America ~ Bank of America Real-Time Payments Wells Fargo Bank ~ Wells Fargo Bank Real-Time Payments Citi Group Bank ~ Citi Bank Real-Time Payments Morgan Stanley Bank ~ Morgan Stanley Real-Time Payments Goldman Sachs Bank ~ Goldman Sachs Real-Time Payments US Bank ~ US Bank Real-Time Payments American Express Bank ~ American Express Real-Time Payments Charles Schwab Bank ~ Charles Schwab Real-Time Payments Bank of New York Mellon ~ Mellon Bank Real-Time Payments Capital One Bank ~ Capital One Real-Time Payments BBT Bank ~ BB&T Real-Time Payments State Street Bank ~ State Street Real-Time Payments SunTrust Bank ~ SunTrust Real-Time Payments Discover Financial Bank ~ Discover Real-Time Payments MT Bank ~ MT Bank Real-Time Payments Northern Trust Bank ~ Northern Trust Real-Time Payments Fifth Third Bank ~ Fifth Third Real-Time Payments Avidia Bank ~ Avidia Real-Time Payments Key Bank ~ Key Bank Real-Time Payments Citizens Bank ~ Citizens Real-Time Payments Regions Bank ~ Regions Real-Time Payments Huntington Bank ~ Huntington Real-Time Payments Comerica Bank ~ Comerica Real-Time Payments E-Trade Bank ~ E-Trade Real-Time Payments List Financial Institutions Enrolled for RTP® (updated monthly) with The Clearing House Fees for RTP ® with The Clearing House - The FedNow Service Real-Time Instant Payment Banks

Real-Time Payments via FedNow instant payment Services are GOOD FUNDS! The RTP System enables Participants to initiate credit transfers, receive final and irrevocable

settlement for credit transfers, and make funds available to Receivers, associated with such

credit transfers in real-time, 24/7/52 a year.

Federal Reserve FedNow instant payment Service Frequently Asked Questions As of 2020, No Financial Institutions are enrolled for The FedNow Service As of 2020, Fees for The FedNow Service have not been issued |

|

{Insert picture of Leigh}

by: Leigh Cook, CEO of Today Payments, Inc.

Having worked in the payments industry over 15, Leigh has seen a lot of changes and participated in some of them directly.

Insert Facebook content here

Insert Twitter account here

|

...See our seminal white paper on

...See our seminal white paper on