"MasterCard Send" Payment Solutions

Benefits &

Features

Send & Receive Money around the World in "Seconds"

Instant Real-time Deposit!

- MasterCard Send is a real-time payments product that allows for cash disbursements between consumers or businesses, or from businesses to individuals. MasterCard Send is the only personal payments service that can reach virtually all U.S. debit card accounts and enable funds to be sent and received typically within seconds, both debit cards and prepaid cards.

Benefits

MasterCard Send™ is a payment service that lets businesses and individuals send money to virtually all U.S. debit card accounts. Send and receive funds typically within seconds. MasterCard Send consumer and business Applications and benefits include:

- Money Transfer: Businesses can send funds to their or another MasterCard account.

- It's Fast: 24/7/365 access to funds anytime vs. several days for checks or ACH transfers to process.

- Funds Disbursement: Merchants can disburse funds to their Vendors, Government Entities or Rebate discounts to their customers' bank accounts or mobile wallets.

Why use MasterCard Send?

See BrochureYou get the flexibility to process transactions directly from your integrated software solution or manually keying them into our Virtual Terminal:

-

MasterCard Send is SAFE: It is safer than cash or checks in protecting users against fraud. The platform uses transaction limits and cross-border blocks to avert money laundering.

- MasterCard debit cards

- non-MasterCard debit cards

Fraud Protection: Identify, manage and prevent suspicious or potentially costly fraudulent transactions with this customizable, rules-based solution for Web merchants.

Cardholder Authentication Programs: Reduce the liabilities and expenses that Web merchants incur from the unauthorized use of credit cards by implementing the Verified by Visa and MasterCard SecureCode programs.

Address Verification Service (AVS): Credit card sales the address given on your site with the address listed on the credit card file at the issuing bank to ensure a match.

- Instant - funds will be received in seconds.

- Flexible - send money in any of 45 currencies.

- Easy - it's all done online or via your mobile, no need to visit the bank.

- Quick - takes seconds to set up.

- Secure - money goes directly into the recipient's account of choice.

- Convenient - funds can be instantly accessed and spent.

- Inexpensive - one of the cheapest on the market as there are no costs for the receiver.

- The amount used to fund the transaction will be the sum of the amount to be sent to the Recipient, plus any fees charged by the Originating Institution.

- The Sender can fund the transaction using a MasterCard card account or other branded card account that the Originating Institution accepts; from a bank account; or with cash, at the bank’s discretion.

- The MoneySend Funding Transaction can be initiated in a number of

ways, including at a bank branch, an ATM, a mobile banking Application,

or a Web-based service such as an Internet banking site, at the bank’s

discretion.

- If the Sender provides a MasterCard card to fund the transaction, the transaction can be processed using a MoneySend Funding Transaction leveraging the MasterCard Worldwide Network.

- If another funding source is used, such as the Sender’s deposit account or non-MasterCard card held at the Originating Institution, the Originating Institution may use an On-Us Transaction. (An On-Us Transaction is an intra-bank transaction to move funds from the Sender’s funding account to the Originating Institution.)

MasterCard Send has the greatest World-Wide Reach: MasterCard Send reaches virtually all U.S. consumers with:

as well as banked and unbanked recipients globally.

MasterCard Send is FAST: 24/7/365 access to funds anytime.

MasterCard Send is EFFICIENT: The platform makes digital payments effortless and more efficient. For businesses, it can drive efficiencies and cost savings.

MasterCard Send is EASY TO USE: It connects users with different payment networks across the globe – all through one digital hub..

We provide a secure way to automatically authorize, process, and manage MasterCard Send card transactions on your web site or web browser. Worried about Internet security? DON'T:

After a transaction is processed, you'll even receive an e-mail with amount confirmation and receiver information. Plus, our payment platform gives you the ability to manually key-in transactions anywhere there's an Internet connection.

Sending money with MasterCard Send is:

How MoneySend works

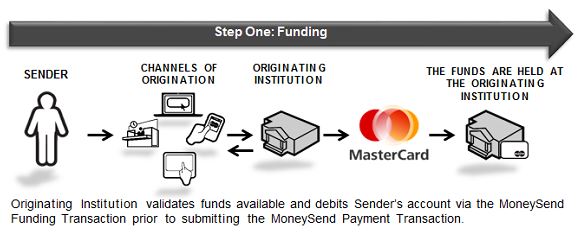

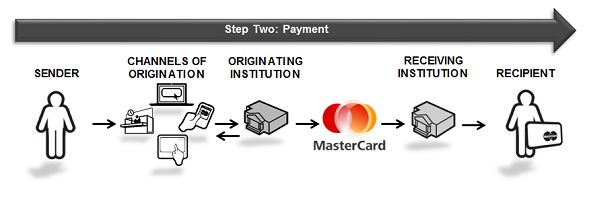

Financial institutions offering MoneySend money transfer services engage in two transactions to accommodate the money transfer between the Sender and the Recipient: a funding transaction and a payment transaction.

Step 1: Funding Transaction

MasterCard provides a Funding transaction to move money from the sender (customer) to the Originating Institution (the financial institution providing the money transfer service); that transaction can be initiated through the MoneySend API.

Step 2: Payment Transaction

The MoneySend Payment Transaction transfers funds from the Originating Institution, via the MasterCard Network, to the account identified by the Recipient at the Receiving Institution. Funds can be transferred to a consumer, credit, debit or prepaid MasterCard®, Cirrus®, or Maestro® account. The Originating and Receiving Institution must both have the ability to process MoneySend transactions.

Have Questions?

We have fast, friendly support!.

Our in-house experts are standing ready to help you make an informed decision to move your company's payment processing forward. Allow us to offer and create an electronic payment processing program to provide you access to your funds in an expeditious manner.

Compare our service and prices to our competitors and

Give Us A Call

(866) 927-7180

- 1. XXX. Please call (866) 927-7180 for details.

- 2. XXX. Call (866) 927-7180 for details.

- Application approval is required. Fees apply. Terms, conditions, features, pricing, support and service options are subject to change without notice. FDIC Insured.

- Credit Card & ACH Transactions are subject to Association guidelines. Additional fees apply when accepting American Express, and Discover cards.